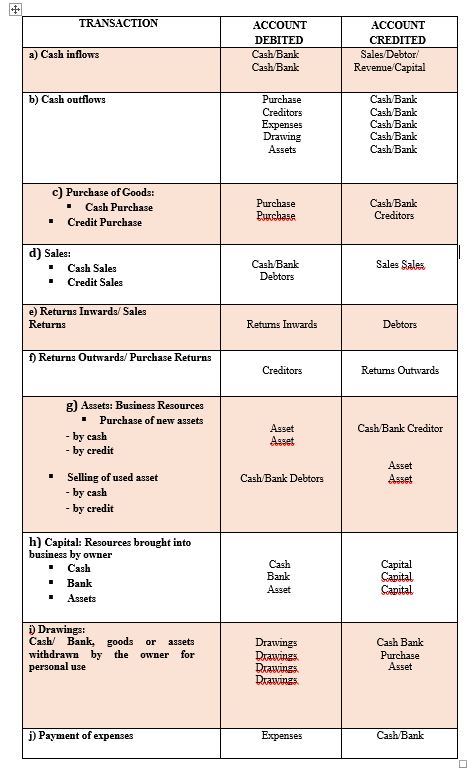

THE DOUBLE-ENTRY RULES

· Since every transaction

affects two items, a bookkeeping entry will have to be made to show an increase

or decrease of one item, and another entry to show the increase or decrease of

another item.

· As each transaction is

being recorded twice, this is known as the double entry principle of bookkeeping.

· There is no limit on the

number of accounts that may be used in a transaction,

but the minimum is two accounts.

· The sum of all debits of

the transaction must be equalled to the sum of credit of transactions

· Debit entries will not

necessary means an increase in the value of an account, and the credit will not

necessary means a decrease value of account.

· The normal balance

according to the type of accounts is shown in table below.

|

ACCOUNT

TYPES |

NORMAL

BALANCE |

|

|

DEBIT |

CREDIT |

|

|

Assets |

√ |

|

|

Expenses |

√ |

|

|

Drawings |

√ |

|

|

Liabilities |

|

√ |

|

Owner’s equity |

|

√ |

|

Revenue |

|

√ |

· Based on the accounting

equation Assets = Liabilities + Capital,

the double entry rules for liabilities and capital are the same, but they are

the opposite for assets.

· The double entry principles for assets,

liabilities and capital are as follows:

|

Account |

|

|

DEBIT |

CREDIT |

|

To

record increase in assets To record decrease in liabilities To

record decrease in capital |

To

record decrease in assets To

record increase in liabilities To

record increase in capital |

v ASSETS

The double entry rule for assets:

|

Assets

a/c |

|

|

DEBIT |

CREDIT |

|

To record increase in assets |

To

record decrease in assets |

Example

Jan 1 Bought

computer worth RM2,500 by cheque

Journal Entries:

Dr Computer a/c RM2,500

Cr Bank a/c RM2,500

|

Computer

a/c |

|||

|

Jan 1 Bank |

RM 2,500 |

|

RM |

|

Bank

a/c |

|||

|

|

RM |

Jan 1 Computer |

RM 2,500 |

Explain the double entries principles for

expenses and revenues

· Revenue are the sale value of goods and

services that have been provided to

customers, whereas expenses are the value of all assets that have been used to

get those revenues.

· The double entry rules

for expenses is the same as assets, whereas the double entry rule for revenues is the same as capital and liabilities.

· The double entry rules for expenses and

revenues are as follows:

|

Account |

|

|

DEBIT |

CREDIT |

|

To

record increase in expenses To

record decrease in revenue |

To record decrease in expenses To record increase in revenue |

v EXPENSES

The double entry rule for expenses:

|

Liabilities

a/c |

|

|

DEBIT |

CREDIT |

|

To record increase in expenses |

To

record decrease in expenses |

·

Trade Discount

o A

trade discount is a term used to address

a reduction in the prices of inventories purchased or sold.

o It

is usually given by businesses to their customers to encourage bulk purchases

of inventories.

o Trade

discount given to a customer result in businesses receiving less, whereas the

trade discount received from suppliers result in

the business paying less.

o The

amount of the discount does not appear

anywhere in the accounting books, and thus, may

also not appear anywhere in the

financial statement.

·

Cash Discount

o A

cash discount is a term used to address a reduction in debts received from

account receivable (customers) or paid to account payable (suppliers).

o It

is usually given by businesses to encourage customers to settle their debts earlier or within a specified period.

o

Discount terms are usually stated in the invoice.

o

There are two types of cash discounts:

a) Discount received (revenue)

– a discount received by the business from its suppliers. This will mean that

the business pays less than the amount it owes to its suppliers.

b)

Discount allowed

(expenses) – a discount given by the business to its customers. This will mean

that the business receives less than the amount owed by its customers.

o The

amount of the discount will be recorded

in every accounting entry, thus will also be recorded in the financial statements.

No comments:

Post a Comment